“Hey @[CoinbasePro; ShapeShift; Kraken; etc], when $NEO?”

This is a Twitter and social media campaign the Neo community has undertaken since 2019. This campaign is underway to bring to the attention of a world-class blockchain project to popular US-based exchanges.

This article serves to highlight various features of the NEO token, the history of the Neo ecosystem, and an overview of its development and use. The thesis of this article is simple – Why western-based exchanges with fiat ramps should list NEO and GAS.

Anecdotally, the author’s initial interest in the project stemmed from the community ethos of BUIDL > shill, which entailed a work first – reward later model. Other differentiating characteristics include Neo’s unique consensus algorithm, passive GAS distributions to NEO token holders, the development team’s long-term vision, and the project’s ability to deliver.

Currently, the NEO token is listed on more than 65 exchanges across the globe, but other than Binance.US, none of the Western-based exchanges with fiat on-ramps. If an exchange like ShapeShift or CoinBase were to list NEO (and GAS), they’d be among the first-movers for US-based and Western markets.

Mission and Values

Neo is building toward a Smart Economy founded upon the trustless trading of digital assets by implementing building blocks for the next-generation internet. Through digital identity standards, the Neo ecosystem seeks to facilitate the digitization of physical, real-world assets and upgrade the methods and processes with which assets are transferred and stored.

Cryptocurrency and blockchain projects with complex ecosystems, built from scratch, are massive undertakings and take years to come to fruition. Further, they require a development community that is passionate and innovative to propagate those visions.

Development of the Neo (formerly Antshares) blockchain began in 2014 and launched its MainNet in 2016. The project has an active in-house development team of more than 40 personnel (per March 2020 NNT podcast with Neo Global Development), as well as a robust international developer community.

In 2017 the Neo whitepaper discussed its vision for the Smart Economy, which consists of digital identity, digital assets, and smart contracts. The whitepaper also discussed cross-chain interoperability, distributed storage, a unique consensus mechanism, plus more. In the time since the release of that whitepaper, there have been the following milestones:

- Neo was the first public blockchain to use a delegated Byzantine Fault Tolerance (dBFT) consensus mechanism and has since updated the protocol to v2.0

- Witnessed the release of an alpha distributed, decentralized storage network

- Two digital identity standards have been released into the ecosystem: VivID and SeraphID

- A cross-chain interoperability protocol is currently under development and claims to offer support with Ethereum, Bitcoin, and Ontology

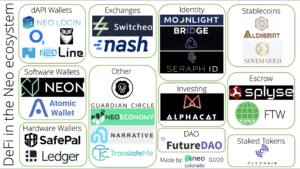

In Q1 2020, the Neo Foundation exhibited active involvement in the development of DeFi in the ecosystem. Examples include investments into Liquefy, an asset digitization entity, and Switcheo, a non-custodial exchange. A current snapshot of the building blocks for a DeFi ecosystem on Neo can be seen below:

Source: Neo Colorado

Currently, five of seven consensus nodes are operated by the Neo Foundation. However, hundreds of nodes that store the blockchain data are live around the globe. Decentralization and governance models will be integrated into the next iteration of the platform.

Looking forward, Neo is upgrading its platform and launching Neo3, which will include all prior development mentioned above, as well as a native oracle network, and many more improvements to enhance the developer experience.

Token Sale

Neo concluded three rounds of token sales for initial funding, which included distributing 10 million NEO in the seed round, 17,649,600 NEO in round one of the public token sale, and 22,832,468 NEO in the second round.

Neo was the first public token sale that offered a refund to participants. In 2017, the Neo Foundation actioned a Giveback Program, which returned US $1,156,043 to 558 NEO fundraising participants.

The roughly 50 million tokens the Neo Foundation held on to were to be (and have since been) allocated in the following manner:

- 10 million NEO – used to motivate NEO developers and NEO Foundation members

- 10 million NEO – used to motivate developers in the NEO ecosystem

- 15 million NEO – used to invest in other blockchain projects

- 15 million NEO – retained as a contingency fund

The two wallet addresses that the Neo Foundation maintain control over are:

- Address one: https://neotracker.io/address/AQVh2pG732YvtNaxEGkQUei3YA4cvo7d2i

- Address two: https://neotracker.io/address/Ae2d6qj91YL3LVUMkza7WQsaTYjzjHm4z1

What are NEO and GAS?

The Neo platform utilizes a dual-token model comprised of Neo (NEO) and NeoGas (GAS). There will only ever be 100,000,000 NEO (which was pre-mined), and 100,000,000 GAS (which will be slowly released as each new block is made through 2038).

NEO is the governance token in the Neo ecosystem, which will be used to vote in the coming governance model integrations with the Neo3 update. The NEO token is indivisible and can only be transferred in whole integers.

GAS is divisible, and also serves as the utility token of the ecosystem that powers transactions, smart contract executions, invocations, and more.

By holding NEO, users passively receive GAS tokens every block. Though, it is not a requirement that individuals stake and lock their tokens to receive rewards. Instead, GAS rewards are distributed to NEO holders each time a new block is minted, which is approximately every 17 seconds on average.

Neo has already been integrated with Ledger, SafePal, and Spatium. There are also a variety of web and desktop wallets that can store NEO and NEP-5 tokens.

Network use and DAUs

According to NeoEconomy.io, there are a total of 923,000 NEO wallets. As of February 2020, the Neo community expanded across various social media platforms (found below).

Source: Neo News Today

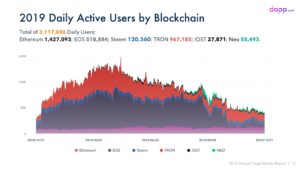

In 2019, dapp.com released its second market overview for the top most popular blockchain networks. The report highlights that there is activity on the Neo network. In such a nascent industry, one of the only robust metrics is network activity. Any cutting edge technology that has a consistent user-base brings with it users who may need to trade digital assets.

Source: Dapp.com

Neo isn’t putting up the spectacular numbers that ETH does with its DeFi applications or Tron and EOS with gambling dApps. However, in 2019, the platform did exhibit an increase in new MainNet public addresses, as well as in unique dApp users.

Source: Dapp.com

On April 15th, 2020, when compared to other non-Proof of Work cryptocurrencies, Neo ranked the highest in total daily transaction volume by US Dollar.

Source: BraveNewCoin

Exchanges and trading volume

Though many aggregators cite 70 million NEO in circulation supply, I remove the amount of NEO the Neo Foundation still manages in its ecosystem funds. At the time of this writing (April 2020), there is approximately 57.2 million NEO in circulation (using the figures from the most recent Neo Financial Report).

Since 2017, NEO has often ranked among the Top 25 coins by trading volume. On April 2nd, 2020, according to CoinMarketCap, NEO had a 24-hour trading volume of $526 million.

Today, NEO, GAS, and or other NEP-5 tokens are listed on more than 64 exchanges.

The only exchange that offers a NEO/USD pairing or fiat on-ramp for US-based investors is Binance.US.

Diverse development community and growing core development

Da Hongfei and Erik Zhang founded Neo (then Antshares) in 2014. The blockchain prototype was launched on TestNet in 2015, and MainNet launched in 2016. Since then, the people and teams responsible for developing and growing the Neo platform have expanded beyond the two cofounders to across the globe.

Currently, there are approximately ten development teams distributed across Europe, China, South America, the US, Russia, and SE Asia.

Below is a list of the decentralized developer communities and the open-source projects they’re working on:

- NGD Shanghai

- Interoperability protocol, core maintenance, support external hardware wallet integration

- NGD Seattle

- Visual Code tools, Azure integration, toolkit for .NET

- Neo St. Petersburg Competence Center (Neo SPCC)

- Decentralized object storage network (NeoFS)

- Neo-GO maintenance

- NEXT

- Tutorials, wallet,

- COZ

- Wallet, Python tools, blockchain explorer, turnstile group of developers

- Spawned Nash, Moonlight,

- NEO-ONE

- JavaScript/TypeScript tools

- Blockchain explorer

- NeoResearch

- Quantum resistance (NeoQS)

- Improvement of dBFT protocol

- NewEconoLabs

- Contract debugger, blockchain browser, wallet,

- Alienworks

- Tutorials

- Neo Node monitoring network

- Neow3j

- Java and Android tools

Progress from each of these groups can be witnessed in each monthly report Neo Global Development releases. Here’s an example from March 2020.

However, with all blockchain and cryptocurrency projects – the proof is in the pudding. To witness the ongoing daily activity in the development of the Neo ecosystem development, visit the following link: https://neonewstoday.com/github/.

Funding for development

Neo development is primarily supported by a fund owned and maintained by the Neo Foundation. According to the 2019 financial report, the Foundation managed approximately US $449 million in assets comprised of USD, CNY, BTC, ETH, ONT, ONG, NEO, and GAS.

The report also highlighted the Foundation’s expenditures for the 2019 fiscal year, which included management and funding of development communities.

Current uses and roadmap

Current use cases and uses include community safety, non-custodial exchanges, workforce development, translation services, stablecoins, and gaming:

- Nash, non-custodial exchange and services provider built by Neo community members

- Moonlight, a distributed workforce platform built by Neo community members

- Guardian Circle, a decentralized community emergency response dApp

- QLC Chain, mobile services and privacy-protecting hardware provider

- Novem, digital tokens backed by physical gold

- TranslateMe, automated translations

- Alchemint, stablecoin

- Various games on the 0xGames platforms, NeoLand, BlockLords, Blockchain Cuties, NeoFish, CryptoFast,

Neo is building toward Neo3, which will integrate a variety of features to enhance blockchain efficiency and the developer experience. The new platform is tentatively slated for launch in Q3 or Q4 2020.

The initial roadmap for Neo3 was released in April 2019. In September 2019, the Neo3 Preview1 TestNet was released for developer communities to begin testing and exploring Neo3 upgrades. Preview2 is purported to be released in Q2 2020.

So, [insert exchange here], why NEO?

First mover advantage.

Currently, the only western fiat on-/off-ramp that offers access to buying NEO and GAS directly with USD is Binance.US. Though a leader in the industry, Binance.US doesn’t have access to a more extensive user base that CoinBase does, nor does it offer non-custodial management like ShapeShift.

NEO exhibits an engaged global market. This statement is supported by the distribution of developer groups that are continuing to build foundations of the ecosystem, as well as the robust community via various social media channels.

Despite a 2018/2019 bear market, the Neo platform exhibited daily active users, as well as ongoing growth in users and uses.

Further, the Neo3 update is going to introduce more straightforward development protocols, new use cases for GAS (i.e., distributed storage and oracle fees), and offer cross-chain interoperability.

It is with the greatest intention that this write-up assists all exchanges when searching for other digital assets to offer support.

0 Comments